Here is the Low-Down or should I say Upsetting News

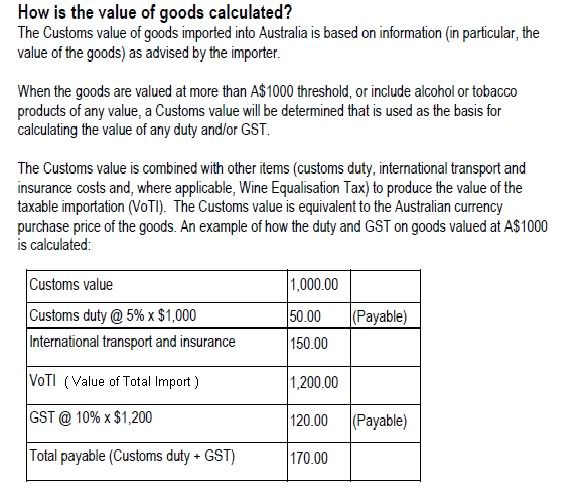

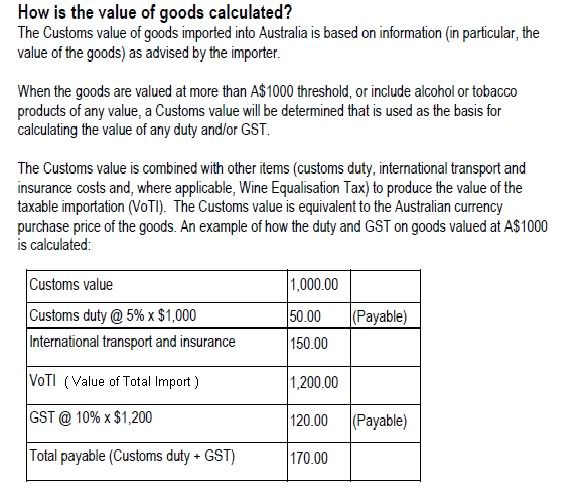

Basically, anything you import into Australia which has a total value of $1000 +Plus (including customs duty, transport/shipping costs, insurance etc) is subject to Aust Custom Import Duty.

The only way you can avoid it is to have the parts sent in separate parcels which will keep the individual parcel values below $1000.

Alternatively, you can request the sender to deliberately De-Value the contents in the parcel on the Customs Decleration Forms, so as to avoid you having to paying the Customs Import Duty.

This is Highly Illegal and not Condoned or Recommended in any Form What-so-Ever.

I have chosen to mention and make you aware of it, in case some BoneBrain convinces you to try it on the presumption that it's "OK" and everyone does it.

The Legal Implications and Penalties associated with this type of activity will scar you indefinitely.

Regards: Sam.