***** ALERT - Nominations for your new ClubCJ Committee can be made here *****

imported body kits, customs? stamp duty? gst? fees ect,

Moderators: Moderators, Senior Moderators

-

vshufflers

- Lancer Newbie

- Posts: 50

- Joined: Sun Jan 02, 2011 12:12 pm

- Location: darwin NT

imported body kits, customs? stamp duty? gst? fees ect,

Hi everbody, does enybody know if you have to pay stamp duty or gst if buying a body kit from overseas? do you need to hire a custom broker? fees ect ect

Play To Win

Here is the Low-Down or should I say Upsetting News

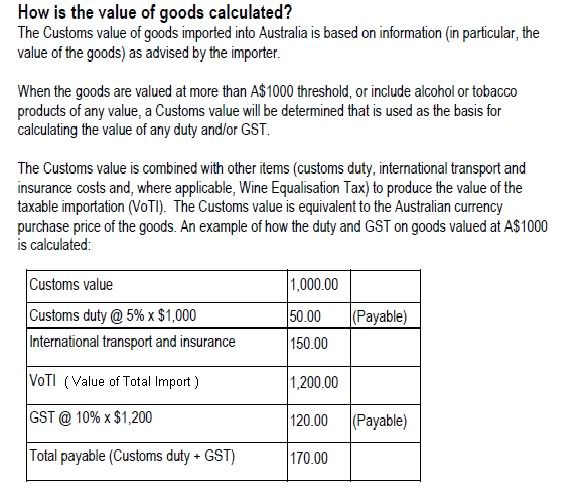

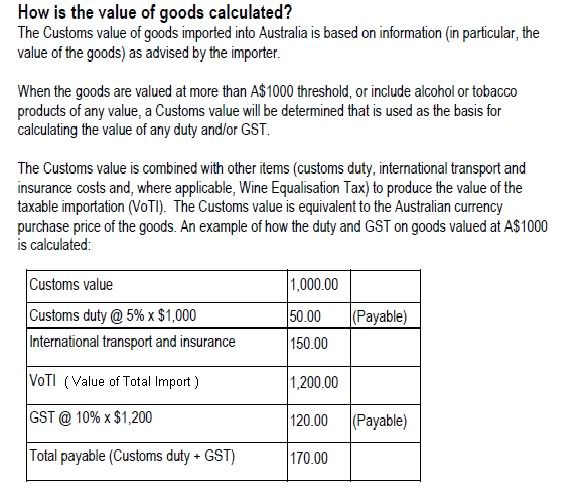

Basically, anything you import into Australia which has a total value of $1000 +Plus (including customs duty, transport/shipping costs, insurance etc) is subject to Aust Custom Import Duty.

The only way you can avoid it is to have the parts sent in separate parcels which will keep the individual parcel values below $1000.

Alternatively, you can request the sender to deliberately De-Value the contents in the parcel on the Customs Decleration Forms, so as to avoid you having to paying the Customs Import Duty.

This is Highly Illegal and not Condoned or Recommended in any Form What-so-Ever.

I have chosen to mention and make you aware of it, in case some BoneBrain convinces you to try it on the presumption that it's "OK" and everyone does it.

The Legal Implications and Penalties associated with this type of activity will scar you indefinitely.

Regards: Sam.

Basically, anything you import into Australia which has a total value of $1000 +Plus (including customs duty, transport/shipping costs, insurance etc) is subject to Aust Custom Import Duty.

The only way you can avoid it is to have the parts sent in separate parcels which will keep the individual parcel values below $1000.

Alternatively, you can request the sender to deliberately De-Value the contents in the parcel on the Customs Decleration Forms, so as to avoid you having to paying the Customs Import Duty.

This is Highly Illegal and not Condoned or Recommended in any Form What-so-Ever.

I have chosen to mention and make you aware of it, in case some BoneBrain convinces you to try it on the presumption that it's "OK" and everyone does it.

The Legal Implications and Penalties associated with this type of activity will scar you indefinitely.

Regards: Sam.

Sam .....

Merlinised MIVEC - AspiRe 2.4L

Merlinised MIVEC - AspiRe 2.4L

SAM-24A wrote:The only way you can avoid it is to have the parts sent in separate parcels which will keep the individual parcel values below $1000.

Alternatively, you can request the sender to deliberately De-Value the contents in the parcel on the Customs Decleration Forms, so as to avoid you having to paying the Customs Import Duty.

This is Highly Illegal and not Condoned or Recommended in any Form What-so-Ever.

You would be quite surprised at how many companies actually do this on a daily basis. They dont do it as per request, they do it as a normal business practice.. Its not just bodykits but other countries if something is marked as 'gift' you dont pay as many fee's. If it keeps logistics costs down and profit up companies will do it regardless of how 'wrong' it may be. Logistics is not cheap. Under valueing stock, fudging the dimensions and weights; if it saves money a company will do it. Handling a large company's outbound freight for a few years and you quickly learn how to get things cheaper...

---

But yes whatever you bring into this country, double the initial purchase price and that will cover your customs, and other charges. Apart from customs, if you went through a customs broker you will have their fees and also the fees of the freight company as well. When I had my bodykit imported it cost 1200 initially and around an extra 800 in fees.

Customs broker, using one will save you a potential nightmare. Once something is inbound (via ship or plane) you have to act fast as if you dont have all your documents that are needed for customs and also for the holding company you will get hit with more fees. Time is money once your goods are inbound...

Importing is not cheap.

Who is online

Users browsing this forum: No registered users and 17 guests